Another challenging financial year. Bringing you new opportunities.

With the end of the financial year approaching, it’s a great time to make smart decisions about your finances. Taking action before 30 June can open up more opportunities for you.

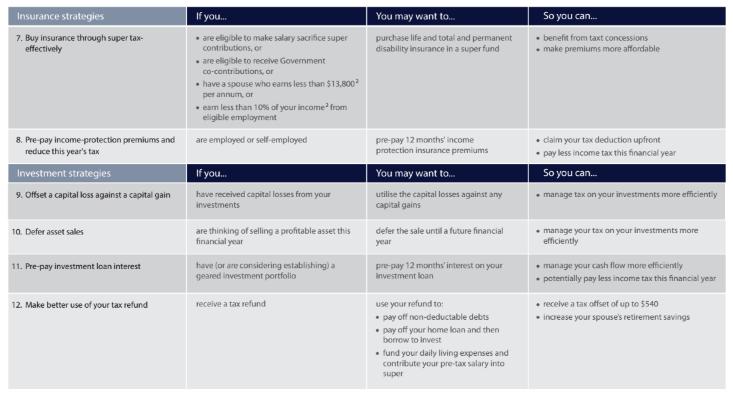

We know that there isn’t a one-size-fits-all solution to wealth management. So we’ve outlined 12 tax-effective strategies that you could benefit from. We can help you find what strategies are right for you, so you can benefit now and also save your retirement.

Note: To use strategies 1 to 7, you generally need to be eligible to make super contributions. Furthermore, you won’t be able to access your super until you satisfy a condition of release.

1 Super strategies should be in consideration of concessional and non-concessional caps. Penalties may apply if these caps are exceeded.

2 Includes assessable income, reportable fringe benefits and reportable employer super contributions. Other eligibility conditions apply.

Source: This information is published by NULIS Nominees (Australia) Limited ABN 80 008 515 633 AFSL 236465, trustee of the MLC Super Fund.