To help you complete your tax return, the following lists outline payments classified as income and those classified as expenses across a range of categories. We’ve also provided an overview of the types of tax offsets (or rebates) and deductions you may be entitled to claim as well as some handy tax tips and hints.

Income

□ Gross salary, wages, earnings, allowances, benefits, tips and directors’ fees as per the PAYG payment summary supplied by your employer.

□ Lump sum and termination payments as per the ETP payment summary supplied by your employer or super fund.

□ Annuities or other pensions, such as account-based pensions, as per PAYG payment summary or statements provided by your financial institution or super fund.

□ Interest earned as per your bank, building society or credit union statements.

□ Dividends received or reinvested, including any franking credits attached as per the dividend statements provided by the company.

□ Distributions from partnerships and trusts (including managed funds) as per the distribution statement provided by the partnership or trust.

□ Details of any capital gains or losses incurred from the sale of (or other dealings involving) CGT assets, such as shares and property. This includes dates and values of acquisitions and disposals, as per purchase and sale documents.

□ Rent received from investment properties as per real estate agent statements or personal records.

□ Details of any foreign source income (including overseas pensions) earned or received, foreign assets held and any foreign taxes paid.

Expenses

Work related expenses (which have not been reimbursed by your employer)

□ Motor vehicle expense details for work related travel in a personal vehicle, including the work-related kilometres travelled.

□ Other work-related travel expenses, such as taxis, public transport and bridge tolls.

□ Purchase of compulsory uniforms, protective clothing and laundry costs for work-related purposes.

□ Self-education expenses, including fees, books, stationery, travel and parking.

□ Union fees and memberships to industry and professional organisations.

□ Purchase of sun protection, hats, sunglasses and sunscreen for work-related purposes.

□ Purchase of tools of trade or equipment for work-related purposes.

□ Telephone accounts for work-related calls.

□ Overtime meal allowances.

□ Attendance fees and travel for work-related seminars, conferences and conventions.

□ Books, journals, subscriptions and your professional library expenses.

□ Home office set-up expenses such as depreciation on purchase of equipment, eg computer, telephone, fax and furniture. Details of home office running expenses such as heating, cooling, lighting and cleaning.

Investment related expenses

□ Motor vehicle expenses for investment-related travel, including investment-related kilometres travelled.

□ Telephone accounts for investment-related calls.

□ Attendance fees and travel for investment seminars, conferences and conventions.

□ Interest paid and fees charged on money borrowed for investments, such as shares.

□ Bank fees incurred on investment-related activities and accounts.

□ Property rental expenses, including advertising, council and water rates, insurance, interest on loans, real estate management fees, repairs and maintenance, travel for inspection, lease preparation, minor capital items depreciation and capital works deductions.

General expenses

□ Donations of $2 or more to registered charities.

□ Tax preparation fees, including travel to your tax agent.

Tax offsets (rebates) and deductions

You may be entitled to the following tax offsets or deductions for the year ended 30 June 2017.

Private health insurance offset

Depending on your income and age, you may be eligible for a tax offset of up to 36 per cent on your health insurance. If you haven’t claimed a reduced premium from your health fund, then you can claim an offset in your tax return.

Spouse super contribution offset

If you made personal superannuation contributions on behalf of a spouse, there is a tax offset of up to $540 per year. This is available for spouse contributions of up to $3,000 per year, where your spouse earns less than $10,800 per year, and a per year rebate for spousal income up to $13,800 per year.

Self-employed super contributions

If you are eligible you can effectively claim a dollar-for-dollar deduction up to the concessional contribution cap. For 2016/17 this cap is $30,000 per person per year ($35,000 for those age 49 or over as at 30 June 2016).

Net Medical expense tax offset

If you received this offset in your 2014/15 income tax assessment, you will continue to be eligible for the offset for the 2016/17 income year if you have eligible out-of-pocket medical expenses above the relevant claim threshold.

This offset will continue to be available if you have out-of-pocket medical expenses relating to disability aids, attendant care or aged care expenses until 1 July 2019.

Child care rebate

As a parent, if eligible, you can claim a 50 per cent tax offset for your out-of-pocket childcare expenses, with a maximum offset of up to $7,500 per child.

To be eligible to claim the child care offset, you must be in receipt of the child care benefit (CCB) from Centrelink for approved childcare and must meet the CCB work, study or training test. You must provide receipts from your childcare provider and the reconciliation letter from the Family Assistance Office.

Senior Australians pensioner tax offset (SAPTO)

If you are eligible for the senior Australians Pensioner tax offset you are able to earn more income before you have to pay tax and the Medicare levy. From 1 July 2016, you will pay no tax on an annual income less than:

□ singles – $32,279 (a reduced offset applies to incomes up to $50,119)

□ couples – $57,948 (a reduced offset applies to incomes up to $83,580)

Tax hints

Superannuation is a very tax-effective vehicle to help you save for your retirement. Following are some tips to help you maximise your super.

Contribution limits

For the 2016/17 financial year, non-concessional (or after tax) super contributions are capped at $180,000 per person per year or $540,000 ($1,080,000 for a couple) over three years using the bring forward provisions. This changes as of July 2017.

Concessional contributions, or those made with pre-tax money, are currently limited to $30,000 per person per year. If you are 49 or over on 30 June 2016, this cap increases to $35,000. This changes as of July 2017.

Prepaying interest

If you have an investment loan you can arrange to prepay the interest on that loan and claim a tax deduction in the same year the interest has been prepaid.

Negative gearing

Negative gearing is another strategy used to manage tax liabilities. Geared investments use borrowed funds therefore enabling a higher level of investment than would otherwise be possible.

Negative gearing refers to the cost of borrowing exceeding the income generated by the investment. This difference is an allowable tax deduction. If you invest in shares, you may obtain imputation credits which can be used to further reduce the amount of tax you pay.

Salary sacrifice

A salary sacrifice strategy allows you to make contributions to super from your pre-tax salary. Your salary is then reduced by the amount you choose to sacrifice and the benefits of this are two-fold: not only does your super balance increase, but this strategy could also reduce your taxable income and therefore the amount of tax you pay.

Not only that, but super contributions are concessionally taxed at just 15 per cent (up to 30 per cent for individuals with income over $300,000) instead of your marginal tax rate, which could be as high as 49 per cent – so you’ve got more to invest in super.

Super co-contributions

If you earn less than $36,021 (including reportable fringe benefits) and make an after tax contribution to super of $1,000, you will be eligible for the maximum super co-contribution of $500 from the Government. The co-contribution amount reduces by 3.33 cents for every dollar of income over $36,021 and phases out completely once you earn $51,021. The ATO uses information on your income tax return and contribution information from your super fund to determine your eligibility.

Super splitting

If you want to split your super contributions with your spouse, don’t forget this can only be done in the year after the contributions were made. Therefore, from 1 July 2017, you are able to split up to 85 per cent of any concessional (or pre-tax) contributions you made during the 2016/17 financial year with your spouse.

Apart from making the most of your super, there are other ways you can minimise your tax liability.

Capital gains and losses

A capital gain arising from the sale of an investment property or shares may be offset by capital losses. For example, you may have had to sell investments that were no longer appropriate for your circumstances and any capital losses realised as a result can be offset against any capital gains you have realised throughout the year. Specialist advice should be sought before dealing with your investments.

Unused losses can be carried forward to offset gains in future years.

Income protection insurance

If you hold an income protection policy in your name, then any premium payments you make are tax deductible. So, be sure to review your insurance.

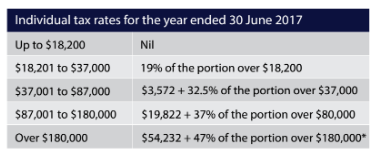

Tax rates for 2016/17

* For any individual with taxable income exceeding $180,000 per annum, the Government has introduced an additional 2 per cent Temporary Budget Repair Levy applicable from 1 July 2014 until 30 June 2017.

Note: This table does not include a Medicare Levy of 2 per cent.

Source: IOOF Investment Management Limited.